Gateway helps insurers go above and beyond customer expectations with proactive claim management.

With technology moving forward at an ever-quickening pace, claim management needs to evolve with it. You risk falling behind if you don’t have full visibility over every part of the claim chain. And there’s no quicker way to lose a customer’s business than to delay settlement of their claim because of disjointed processes and outdated information.

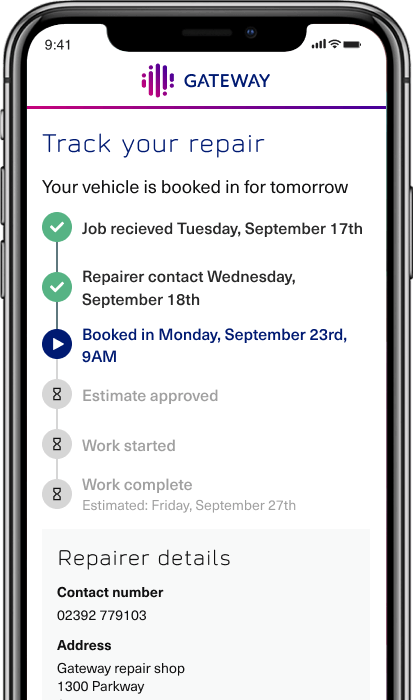

Gateway’s flexible claim management module helps insurers to expand their field of vision and respond quickly to new insurance scenarios in a constantly moving and changing market. From the first notification of loss, Gateway links every participant in the network with dynamic real-time data, on-demand and with 360-degree visibility as the claim progresses. Gateway ensures you never lose sight of your customer.