Cutting the cost of total loss with data-driven insight.

Calculating the cost of a total loss to determine a repair or write-off decision requires instant, accurate assessment and valuation data. Everyone in the claim and repair chain – insurers, repairers, salvage companies and other supply partners – need to be constantly interconnected to drive seamless data flows and deliver accurate decisions.

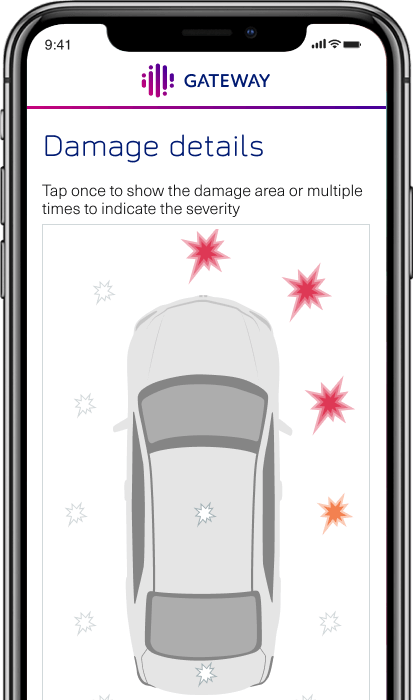

Gateway enables faster, accurate data-driven decisions that reduce indemnity exposure, and optimise supply chain performance. That adds up to reduced processing time and speedier resolution for customers. Gateway allows you to connect to any network and supply chain anywhere at any time to get full line of sight on total loss costs.